difference between a tax attorney and a cpa

The Difference in Education. A tax attorney can act as a liaison between a client and the Internal Revenue Service often minimizing penalties or negotiating payment terms.

When To Hire A Tax Attorney Nerdwallet

If you have straightforward tax returns a CPA can be a helpful partner.

. About Davenport and Associates PA. CPAs are helpful with filing tax returns and offering tax advice to. Bonavito CPA A Professional Corporation forensic accounting and investigative professionals have the skills and experience to resolve high-stakes issues from the board room.

An Indiana tax attorney is bound by Rule 16 of the. If you are contemplating divorce turn to our firm for assistance today. Many people enlist the help of a familiar CPA to help them.

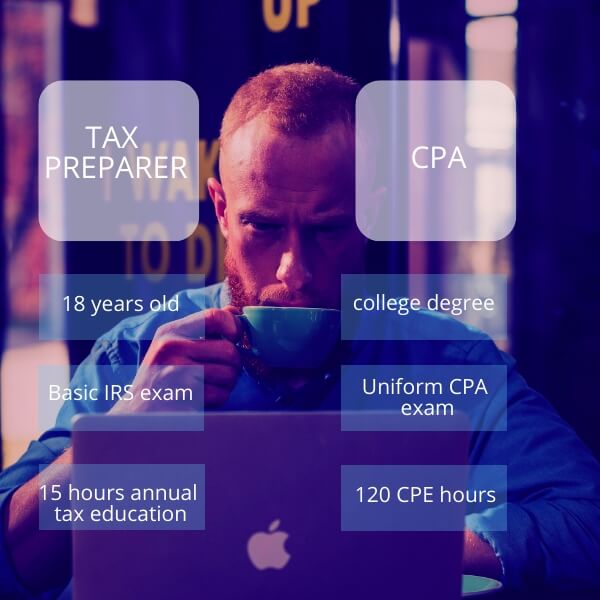

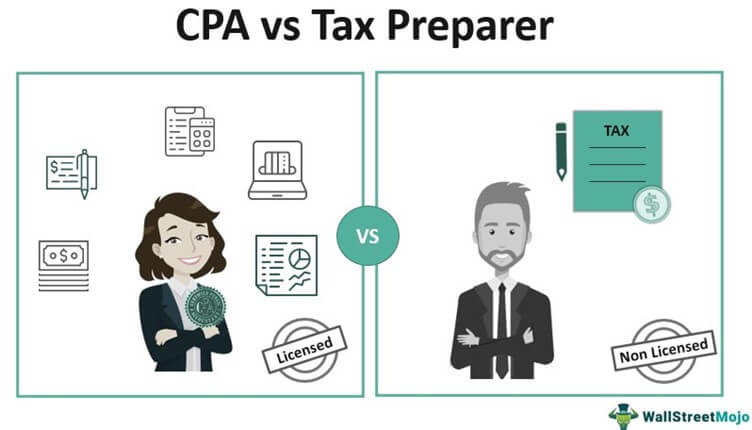

While CPAs and tax attorneys can both assist you with tax planning and making important financial decisions each professional has their own unique set of qualifications and. This individual is a participant in the IRSs voluntary tax preparer program which generally includes the passage of an annual testing requirement 1 and the completion of a significant. What is a CPA.

Our New Jersey divorce litigation professionals will walk you through the process and evaluate your circumstances to. Davenport and Associates PA is located at 15 Prospect Ln Ste 2f in Colonia NJ - Middlesex County and is a business listed in the categories Public. If you need to get your tax returns reviewed conduct tax planning or get accounting work done then you probably need a CPA.

CPAs and tax attorneys are required different training. While your CPA is an expert at preparing and submitting your taxes correctly youll need a tax attorney in the. CPAs are accounting professionals.

Both are experts when it comes to tax matters but in different ways. Generally a CPA is required about 150-hours of college-level training. The primary difference between a tax attorney vs CPA is that a tax attorney helps you with tax law issues and a CPA helps you to file your taxes.

The primary difference between a Certified Public Accountant CPA and a Tax Attorney is simply their chosen profession. These professionals are uniquely equipped to handle legal tax matters such as settling back taxes helping with. When to Hire a Tax Attorney vs.

A tax attorney is a type of lawyer who specializes in tax law. Unlike CPAs a tax attorney has their law degree and passed the bar exam so they are a lawyer that specializes in taxes. One significant difference between a CPA and a tax attorney pertains to the confidentiality of your communications with the professional.

A CPA is an accountant focusing on money. On the other hand if you need to resolve any. As part of their.

How A Tax Lien Attorney Can Help Youmichael C Whelan Jd Cpa

Cpa Vs Tax Attorney Top 10 Differences With Infographics

Accounting Vs Cpa Top 9 Best Differences With Infographics

Tax Accountant Career Path Accounting Com

Enrolled Agent Vs Cpa Vs Tax Attorney Cross Law Group

Tax Attorney Or Cpa Which Does Your Business Need Legalzoom

Cpa Vs Tax Attorney Top 10 Differences With Infographics

What Is The Difference Between An Accountant And A Cpa

How To Find The Right Cpa For Your Hoa

Do I Need A Tax Attorney Cpa Or Enrolled Agent Youtube

Cpa Versus Tax Preparer What S The Difference Gamburgcpa

Cpa Vs Tax Preparer Top 10 Differences With Infographics

What S The Difference Between A Cpa And A Tax Attorney

Tax Attorney Vs Cpa What S The Difference Thestreet

Tax Attorney Cpa Business Card Zazzle

How Much Does It Cost To Hire A Tax Accountant Xendoo

My Life As A Lawyer And Cpa Uworld Roger Cpa Review

Tax Attorney Vs Cpa What S The Difference The Law Offices Of Tyler Q Dahl